Investing in under market real estate in San Antonio has treated me well over the years. I firmly believe that investing in under market value fixer upper San Antonio properties for the long term is the best way to enjoy long term cash flow.

If you are on the fence and are about to dive into buy and hold investing, I have some simple tips to share, as a successful San Antonio property wholesaler:

- Work with a real estate agent and investor

Most real estate agents just represent people who are buying or selling their personal residence at retail prices. The majority of agents do not invest in real estate themselves, so they are often unable to help you find a good under market value fixer upper that will produce good positive cash flow.

It can help to become an agent yourself so you can source your own deals, but it’s not essential at first.

You need to get a San Antonio wholesale property under market value enough so that when you do the repairs and collect rent from the tenant, you will have enough to cover all of your expenses. These usually include mortgage, taxes, insurance, repairs and vacancies.

Right now, the San Antonio real estate market is pretty hot, and good fixer upper deals for affordable homes are harder to find. This is why working with a highly experienced real estate agent and investor is so important: She can help you find a good under market value deal that can produce cash flow. Also, if you work with an experienced investor agent, she will probably have a good rehab crew that can do the fix up work at a fair price.

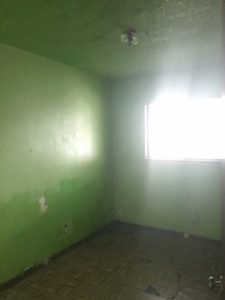

Here is a nice wholesale property deal in San Antonio I just found that will produce $1150 per month in rental cash flow:

Address: 126 E Dullnig Ct., San Antonio, TX 78223

Year Built: 1919

Description: Major cash flow on this San Antonio fixer upper distressed property – 4 beds 1 bath, 1100 sqft, two large storage units in the back, Lot Size: .19 acres, Yearly taxes: $1,600.00, Estimated yearly insurance $700.00, Estimated repairs: 30K, includes interior paint, electrical/plumbing up to code, landscape, trash removal, kitchen/bath updates, central HVAC, flooring, 2 room conversations, foundation/roof repairs.

Max ARV: $109-$115k

Cash Price: $55,000

If you do that San Antonio distressed property all cash, you should have about $700 left for positive cash flow – not bad! – after expenses.

You need to carefully consider if the wholesale property you want to buy will generate the cash flow you want.

A very common error for new fixer upper investors is to overdo the rehab or not be aware of all the things that have to be fixed.

- Only invest if the cash flow is there

I never buy an under market value property based upon what I think the value of the house will be in a few years. That is real estate speculation and that is a great way to end up in the poor house. If after I run the numbers – property cost, rehab cost, all expenses – I generate positive cash flow of a few hundred dollars, I do the deal.

- Don’t forget repairs and vacancies

I like to account for at least $50 per month for repairs on my fixer upper deals in San Antonio. Also, plan on a 5% loss for vacancies. However, I often do San Antonio Section 8 rentals, and I find that this type of rental income is quite solid and safe; I have Section 8 tenants who have been with me for 5 years or more.

Above all, after you find a good potential under market value property that will produce positive cash flow, do the deal. Don’t sit around thinking about it too long or you may never take action. Many people think about investing in San Antonio wholesale property, but the majority never do a deal because of fear.

If you do your due diligence as I outline, there should be no reason to not move forward on that property!

Before Rehab – $50,000 cash purchase, zero rehab by investor, 90 DOM, resold for $80,000 owner finance, $804 per month, 14% ROI.

Before Rehab – $50,000 cash purchase, zero rehab by investor, 90 DOM, resold for $80,000 owner finance, $804 per month, 14% ROI.